Adoption allowed me to fulfill my dream of finally becoming a mother, and my flexible work schedule allows me to be the mom I’ve always wanted to be. Here’s how you can make it work, too.

Real Adoption Stories

| MY MEMBERSHIP |

Click below for subscriber-only access to:

> Read Magazine Issues

> Listen to Expert Audio

> Search the AF Library

> Manage Your Account

|

FOR MEMBERS ONLY Search the Adoption Parenting Library |

GROWING UP ADOPTED

Infants

“From Waiting Mom to Flexible Working Mom”

Lessons I’ve Learned from My Children

Over decades as a foster and adoptive parent and an adoption social worker, I have mothered and supported hundreds of children. Each one has taught me more than I passed along to them. Here is just some of that wisdom.

Book Review: The Safe Baby

The Safe Baby is an easy-to-follow resource that will give busy parents — adoptive or otherwise — peace of mind.

Preschoolers

Celebrating Sameness in Your Family

Help your preschooler process the world around him by pointing out the ways you are alike.

Dolls and Toys for Our Families

We asked readers, “Have you found any dolls or other toys that reflect your child’s race and/or birth culture that you would specifically recommend?” Here are the top picks.

“Why Was I Adopted”

Your preschooler may hit you with surprising questions at the most unexpected times and places!

School Kids

Ask AF: Letting a Preteen Take the Lead in a Birth Parent Relationship

“At what age should we start letting our daughter take the lead in birth parent contact? I know that my daughter will be able to call her birth mom freely when she gets her own cellphone, so how do we step back responsibly?”

“On Parenting from Afar”

Once, I grieved the loss of a biological child. Nineteen years later, as I watch my son leap and soar (literally) into adulthood, I am at peace with my role of nurturing the many gifts built into his nature.

Ask AF: Seven-Year-Old Has Been Saying She Doesn’t “Belong Here”

Parents are puzzled by their seven-year-old’s new questions and feelings about adoption. Adoption expert Beth Friedberg, LCSW, offers an explanation and talking tips.

Teens

Mothering Children of Color Who Are Becoming Adults

As my children move into the world without me, I can’t protect them the way I could when they were little. I can’t assume that their lives and actions will be cloaked with the same privilege I was born with.

Ask AF: Letting a Preteen Take the Lead in a Birth Parent Relationship

“At what age should we start letting our daughter take the lead in birth parent contact? I know that my daughter will be able to call her birth mom freely when she gets her own cellphone, so how do we step back responsibly?”

“On Parenting from Afar”

Once, I grieved the loss of a biological child. Nineteen years later, as I watch my son leap and soar (literally) into adulthood, I am at peace with my role of nurturing the many gifts built into his nature.

Adopting

- All

- Adoption Laws by State

- ART Options

- Cost & Timing

- Decisions

- Domestic

- Foster

- International

- International Adoption Countries

“From Grief to Joy”

When you lose a parent or grandparent, you mourn the past. When you lose a child, as I lost my 24-year-old daughter, you grieve for the future that will not be. By adopting after this unimaginable tragedy, I wasn’t aiming to bury my grief or to start over, but to start a new beginning.

Wyoming Adoption Laws and Policies

Learn about Wyoming adoption laws and find adoption agencies and attorneys who work with families in your state.

News Brief: WHO Set to Broaden Definition of “Infertile” to Include Singles and Same-Sex Couples

Under the World Health Organization’s previous definition, infertility was failure to achieve pregnancy after 12 months or more of regular unprotected sexual intercourse. Its expanded version will apply to more families.

Adoption Cost and Timing in 2016-2017

Each year, Adoptive Families polls newly formed families across the country to get actual information on the cost and length of time it took them to complete their adoptions. See the results of the most recent 2016-2017 Adoption Cost & Timing Survey.

“From Grief to Joy”

When you lose a parent or grandparent, you mourn the past. When you lose a child, as I lost my 24-year-old daughter, you grieve for the future that will not be. By adopting after this unimaginable tragedy, I wasn’t aiming to bury my grief or to start over, but to start a new beginning.

Parents Share: Our Last-Minute “Stork Drop” Adoption

We asked, did you get “the call” that you’d been selected by a birth mother after the baby was already born? Parents respond with their experiences and been-there advice.

Ask AF: What to Do the First Time a Foster Child Comes to Stay with Us?

“We are preparing for our first overnight visit with sisters we hope to adopt from foster care, and are nervous. What are we supposed to do for 24 hours with two children who are essentially strangers?”

“Finding My Inner Mom”

For years, I felt ambivalence about becoming a parent, and worry that I wouldn’t be a “perfect” mother. In an open letter to my daughter, I look back on that moment of calm and utter clarity when we met.

Ecuador Adoption Fast Facts

Wondering how to adopt from Ecuador? Find statistics, prospective parent requirements, personal stories, and more resources.

Bonding

“It Takes No Special Power to Love a Child”

As she anticipates the release of her documentary Hayden & Her Family, the filmmaker reconnects with the mother of 12 she profiled to discuss special needs adoption, parenting outside “normal” boundaries, and how loving a child changes you.

“Breathing”

As I prepared to adopt my second child, I welcomed the home study worker into a perfectly clean and ordered home. The scene that greeted her at her post-placement visit was, well, different—but much more real.

“Finally Father’s Day”

I became a dad at age 50, and it changed my life in ways I never could have expected. It was the greatest gift.

“Breathing”

As I prepared to adopt my second child, I welcomed the home study worker into a perfectly clean and ordered home. The scene that greeted her at her post-placement visit was, well, different—but much more real.

“It Takes No Special Power to Love a Child”

As she anticipates the release of her documentary Hayden & Her Family, the filmmaker reconnects with the mother of 12 she profiled to discuss special needs adoption, parenting outside “normal” boundaries, and how loving a child changes you.

ADVICE & SUPPORT

Foster Adoption

Ask AF: What to Do the First Time a Foster Child Comes to Stay with Us?

“We are preparing for our first overnight visit with sisters we hope to adopt from foster care, and are nervous. What are we supposed to do for 24 hours with two children who are essentially strangers?”

Ask AF: Advice for Our “Ice Breaker” Meeting with a 10-Year-Old Boy?

“We are adopting from foster care and have an ‘ice breaker’ meeting with a 10-year-old boy scheduled for tomorrow. I’m super nervous. Can anyone share advice about forging a connection?”

“What Being a Foster Family Has Taught My Children”

Amazingly, the number one question we’re asked about being a foster family is: “Are you afraid of what they’ll teach your children?” So, what have my kids learned? To start—to be open, generous, non-judgmental, thankful for their warm home….

Domestic

Parents Share: Our Last-Minute “Stork Drop” Adoption

We asked, did you get “the call” that you’d been selected by a birth mother after the baby was already born? Parents respond with their experiences and been-there advice.

Share Your Story: Announcing Your Decision to Adopt

We polled our newsletter subscribers, “How did you tell your extended family about your decision to adopt?” Here’s what some of you said.

Online Adoption Resources for Prospective Parents

Our recommendations for online adoption resources — from government sites to attorney directories — selected by the editors of Adoptive Families magazine.

International

“Finding My Inner Mom”

For years, I felt ambivalence about becoming a parent, and worry that I wouldn’t be a “perfect” mother. In an open letter to my daughter, I look back on that moment of calm and utter clarity when we met.

“Our Journey to China to Adopt Our Daughter”

We left our house this morning a family of three, but the next time we walk through our front door, it will be as a family of four.

“Visiting Our Daughter’s Russian Orphanage”

Three years after her adoption, we returned to our daughter’s Russian orphanage to visit her caregivers and friends there.

Talking

Parents Share: No End to the Nosy Adoption Questions

When you formed your family through adoption, everyone seems to think it’s their right to ask you nosy questions about adoption. Readers share some of the most common—as well as some of the most outrageous.

“Sliding Doors”

We all imagine different ways our lives could have played out. For adoptees, these fantasies may seem particularly compelling: ‘What would my life have been like if I had not been adopted?’

Capturing Your Child’s Journey Through Life

Four families share how they fit making scrapbooks and lifebooks into their busy lives after adopting.

Ask AF: Should We Tell Our Child She Has a Birth Sibling if They Can’t Be in Touch?

“Would knowing that somewhere, out in the world, she has a biological sister—but one she can’t get in touch with or live with as a sibling—help our child, or be harmful?”

Parents Share: No End to the Nosy Adoption Questions

When you formed your family through adoption, everyone seems to think it’s their right to ask you nosy questions about adoption. Readers share some of the most common—as well as some of the most outrageous.

Ask AF: Worried My Daughter Will Think Her Birth Mom Is More “Fun”

“My nine-year-old has been asking me about her birth mother. I was able to find her on social media, but I’m worried about sharing the photos I found.”

Transracial

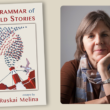

The Grammar of Untold Stories: An Interview with Lois Melina

Lois Melina has been a voice of wisdom and authority in the world of adoption for decades. We connected with Melina upon the publication of her latest book, The Grammar of Untold Stories,a collection of personal essays, to discuss immigration and international adoption, transracial adoption and the Black Lives Matter movement, and the many ways adoption and infertility continue to surface in her writing.

“Almost Famous”

The day we became a transracial adoptive family was the day we lost our anonymity in our community. We’ve learned to handle the extra attention with some advance prep before going public, some choice words, and some perspective.

An Overview of Heritage Travel

Heritage travel can help your child understand her birth culture, and her origin story. Plan a trip that will work for your family by answering these questions.

The Grammar of Untold Stories: An Interview with Lois Melina

Lois Melina has been a voice of wisdom and authority in the world of adoption for decades. We connected with Melina upon the publication of her latest book, The Grammar of Untold Stories,a collection of personal essays, to discuss immigration and international adoption, transracial adoption and the Black Lives Matter movement, and the many ways adoption and infertility continue to surface in her writing.

Health & Development

“It Takes No Special Power to Love a Child”

As she anticipates the release of her documentary Hayden & Her Family, the filmmaker reconnects with the mother of 12 she profiled to discuss special needs adoption, parenting outside “normal” boundaries, and how loving a child changes you.

Family Dynamics

“Breathing”

As I prepared to adopt my second child, I welcomed the home study worker into a perfectly clean and ordered home. The scene that greeted her at her post-placement visit was, well, different—but much more real.

School

Parents Share: What My Child’s Friends Want to Know About Adoption

Parents share the questions their children have been asked by friends and classmates over the years, from being in an orphanage to whether they know their “real” parents.

Peers & Friendships

Hosting Productive Play Dates

A step-by-step plan to help adoptive parents plan successful outings for children and their friends.

Modern Families

“From Grief to Joy”

When you lose a parent or grandparent, you mourn the past. When you lose a child, as I lost my 24-year-old daughter, you grieve for the future that will not be. By adopting after this unimaginable tragedy, I wasn’t aiming to bury my grief or to start over, but to start a new beginning.

Holidays & Celebrations

Parent-to-Parent: Holiday Gifts for Your Child’s Birth Family

We asked our readers: If you’ll be giving your child’s birth parents a gift this holiday season, what is it and how will you give it to them? Read the answers from adoptive parents.